Multimedia content

- Images (5)

- Reshaping realities: Africa’s post-pandemic recovery is likely to be prolonged and uneven, but could also be transformative (1)

- Reshaping realities: Africa’s post-pandemic recovery is likely to be prolonged and uneven, but could also be transformative (2)

- Reshaping realities: Africa’s post-pandemic recovery is likely to be prolonged and uneven, but could also be transformative (3)

- Reshaping realities: Africa’s post-pandemic recovery is likely to be prolonged and uneven, but could also be transformative (4)

- Reshaping realities: Africa’s post-pandemic recovery is likely to be prolonged and uneven, but could also be transformative (5)

- Links (1)

- All (6)

Reshaping realities: Africa’s post-pandemic recovery is likely to be prolonged and uneven, but could also be transformative

The COVID-19 pandemic has undoubtedly eroded the overall improvement in risk-reward scores seen across the African continent in recent years, but this should not deter investors

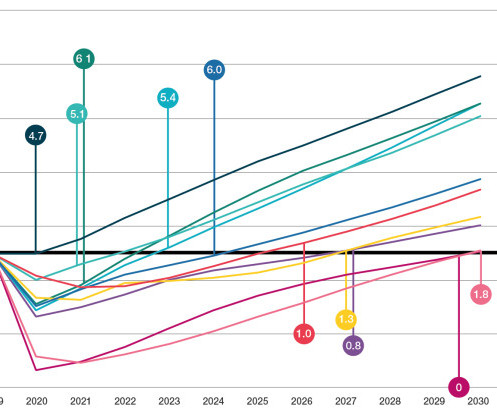

The economic impact of COVID-19 will be varied but the recovery will be even more so

Specialist risk consultancy Control Risks (www.ControlRisks.com) and independent global advisory NKC African Economics, the Africa-focused subsidiary of Oxford Economics, have today launched the fifth edition of the Africa Risk-Reward Index.

The 2020 Africa Risk-Reward Index and graphics can be downloaded here: https://bit.ly/3kks3Yy

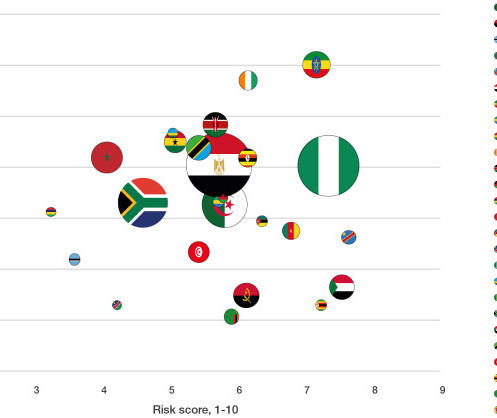

The index offers a comparative snapshot of market opportunities and risks across the continent. It provides a grounded, longer-term outlook of key trends shaping the investment landscape in major African economies, which should inform the strategies of organisations looking to invest in or grow their business in Africa. Investors seeking to minimise risks and maximise rewards are cautioned not to focus on headlines, but rather on specific country, sector and project contexts.

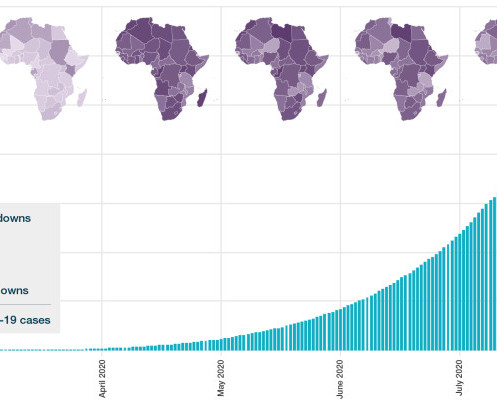

The COVID-19 pandemic has undoubtedly eroded the overall improvement in risk-reward scores seen across the African continent in recent years, but this should not deter investors. Africa’s recovery may be prolonged and uneven, but it could also be transformative.

The pandemic’s huge economic cost has triggered a universal drop in our reward scores, but the impact on risk scores has been more varied. Ethiopia has seen the largest ratings drops as COVID-19-induced challenges combine with escalating ethnic tensions in the context of a delayed election. Egypt’s risk score has remained relatively steady, but its reward score has been badly hit by the triple blow of the pandemic, low oil prices and plummeting tourism revenues. Algeria’s risk score has improved since the mass protests and landmark elections of 2019, but challenges for its oil-dependent economy have still dragged down its overall score.

“The COVID-19 pandemic is a global crisis, but Africa’s recovery will be slower and more uneven than most,” warns Barnaby Fletcher, Associate Director at Control Risks. “However, this recovery will be an opportunity for governments across the continent to address structural constraints and promote new solutions. We are already seeing signs that they are doing so, and for investors this opens up some interesting opportunities.”

This 2020 edition of the Africa Risk-Reward Index examines the longer-term implications of COVID-19 on Africa. The first article looks at the longer-term impact of COVID-19 and imagines a post-pandemic landscape, while the second explores the role that African tech can play in revitalising more traditional industries. The last article covers the growing efforts by both external and domestic actors to manipulate the public debate in Africa through influence operations and disinformation campaigns, and the risks these efforts pose to commercial companies.

Post-pandemic: The impact of COVID-19 and outlooks for Africa’s recovery

The immediate impact of COVID-19 will see Africa experience its first recession in 25 years, but more worrying is the lack of fiscal headroom available to African governments to engage in stimulus spending. For many countries, economic recovery will have to be driven by their private sectors, which were already weak and have only become weaker during the pandemic.

“The economic impact of COVID-19 will be varied but the recovery will be even more so” says Jacques Nel, Head of Africa Macro at NKC African Economics. “The optimists will hope to see a race to the top as governments undertake desperately needed reforms, while the pessimists will see a continent set back more than a decade. The reality will be somewhere in between, with each country finding a unique spot on this spectrum.”

However, there are already indications that the scale of this crisis is prompting some welcome reforms. Faced with a volatile global landscape, African governments have a pressing need to develop downstream manufacturing, regional supply chains and domestic capital markets. There are also indications that large portions of the workforce are entering the formal economy to access government financial support and cope with pandemic containment measures. Some of these trends were set in motion before its outbreak, but COVID-19 seems to have accelerated them. Investors who stay with Africa despite the current downturn will not only have an important role to play in its recovery, but will also see some exciting changes and opportunities.

The great enabler: How Africa is using new digital solutions to revitalise old industries

Investment into African tech has reached record levels in recent years. These are likely to fall in 2020, a consequence of both recent high-profile sector struggles and the impact of COVID-19 on external finance. However, any such decline should be viewed as an opportunity to reset expectations and approaches, not as an indication that the affected sectors are becoming less attractive.

COVID-19 has served to emphasise the need for tech and digital solutions across the continent. It has sparked the development of healthcare apps to help fight the pandemic, e-commerce platforms to facilitate life under lockdown, and new payment and microinsurance systems.

Digital and tech is set to play a far greater role in post-pandemic Africa than it ever did before. The wave of informal workers and companies entering the formal economy will need access to basic financial and legal services, which are likely to be provided through online or mobile platforms. Digital solutions may also help facilitate the growing push to build regional supply chains.

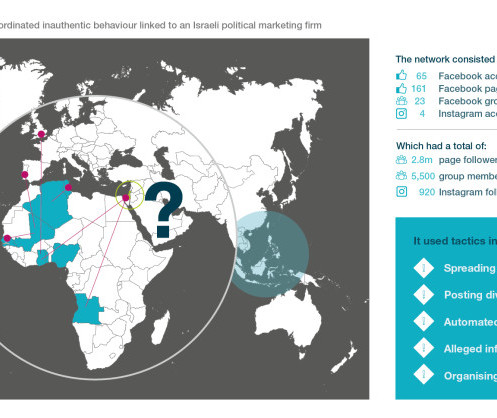

Hostile narratives: Reputation and African geopolitics in the age of influence operations

Africa has always struggled to set its own narrative and get past generalisations that cast the entire continent as beyond redemption or the next economic powerhouse. This struggle is becoming more acute as internal and external actors actively push false narratives through influence operations and disinformation campaigns.

Foreign powers engaged in such tactics are motivated the geopolitical competition over Africa, which has steadily intensified over the past decade. African governments are also building their own capacity to mount such campaigns.

Investors should not assume that such activities impact only governments. Foreign investment is frequently the subject of political debate in African countries, and when that debate is distorted by external actors, individual companies face significant reputational risks. Not only that, but disinformation campaigns have been used by militant groups for recruitment and to cause peaceful protests to escalate into violence, posing security threats to commercial operations.

The risk posed by influence operations in Africa should not be overstated, though the trend is growing as social media is adopted more widely across the continent. Just as grasping the political and business landscape can help investors avoid pitfalls and maximise their chances of success, understanding the information landscape – what the narrative is and who is seeking to influence it – will become increasingly important.

Methodology

The Africa Risk-Reward Index is defined by the combination of risk and reward scores, integrating economic and political risk analysis by Control Risks and NKC African Economics, the Africa-focused subsidiary of Oxford Economics.

Risk scores from each country originate from the Economic and Political Risk Evaluator (EPRE), while the reward scores incorporate medium-term economic growth forecasts, economic size, economic structure and demographics.

For details on the individual risk and reward definitions, please contact us on enquiries@controlrisks.com or africa@oxfordeconomics.com.

Distributed by APO Group on behalf of Control Risks Group Holdings Ltd.

Issued on behalf of Control Risks and NKC African Economics, an Oxford Economic Company.

Media Contact:

Claire Peddle

Marketing Director, Middle East and Africa

claire.peddle@controlrisks.com

+971 50 600 5993 (Dubai)

Shreena Patel

SEO & Digital Marketing Specialist

spatel@oxfordeconomics.com

+44 (0) 7999379025 (London)

About Control Risks:

Control Risks (www.ControlRisks.com) is a specialist risk consultancy that helps create secure, compliant and resilient organisations. We believe that taking risks is essential to success, so we provide the insight and intelligence you need to realise opportunities and grow. From the boardroom to the remotest location, we cut through noise and emotion to give you dependable advice when you need it most. We have been assisting clients in Africa for the past 40 years and today we have eight offices across five countries on the continent, alongside an unrivalled network of embedded consultants and on-the-ground network. We work with the largest investors into Africa and the largest African companies, from mining and energy to media and telecommunications.

About NKC African Economics and Oxford Economics:

NKC African Economics (www.AfricanEconomics.com), based in South Africa, has specialised in macroeconomic research in Africa since 2003. Insights are provided within the context of comprehensive knowledge of the African continent, its history, and each country’s unique political and economic setting. In 2015 we became part of the Oxford Economics group, to better combine Oxford Economics’ global base and unparalleled technical expertise in modelling with our Africa-specific skills and insight.

Oxford Economics (www.OxfordEconomics.com) is a leader in global forecasting and quantitative analysis. Our worldwide client base comprises more than 1,500 international corporations, financial institutions, government organisations, and universities. Headquartered in Oxford, with offices around the world, Oxford Economics employs 400 people, including 250 economists and analysts. The group’s best-of-class global economic and industry models and analytical tools give us an unmatched ability to forecast external market trends and assess their economic, social and business impact.

About Control Risks and Oxford Economics:

Control Risks and Oxford Economics have partnered to provide an innovative political and economic risk forecasting service that takes a holistic view of risk in a complex, rapidly changing, globalised world. Control Risks and Oxford Economics combine extensive geopolitical, operational and security expertise with rigorous economic forecasts and models on 200 countries and 100 industries. Together, we offer full-spectrum consulting that enables your organisation to navigate the world of political and economic risk. Covering all aspects of the investment journey, including security and integrity risk, our joint consultancy practice can overlay geopolitical and economic scenarios to bring new insights and direction to your business.