Multimedia content

- Images (1)

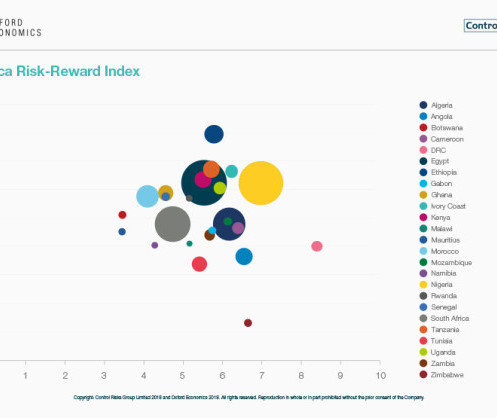

- Africa Risk Reward Index

- Documents (1)

- Africa Risk Reward Index

- Links (2)

- All (4)

Political change boosts risk-reward score in Southern African markets

Zimbabwe, Mozambique and South Africa among the top ten African economies improving the reward while reducing the risks for investors

In South Africa, investor confidence has improved, following the appointment of Cyril Ramaphosa as state president, as the implementation of policies

Broad political change has led to an improvement of the risk-reward score in many Southern African economies, according to the 2018 Africa Risk-Reward Index from Control Risks (www.ControlRisks.com) and Oxford Economics. Zimbabwe, leading with the largest positive change, Mozambique and South Africa saw economic and social reforms after leadership changes in 2017 and early 2018, positively impacting the business environment and investor confidence.

George Nicholls, Senior Partner for Southern Africa at Control Risks, comments:

“South Africa, Zimbabwe and Mozambique have seen remarkable changes since the last edition of the Africa Risk-Reward Index published in September 2017.

“In South Africa, investor confidence has improved, following the appointment of Cyril Ramaphosa as state president, as the implementation of policies – intended to consolidate fiscal expenditure and tackle corruption in public institutions and state-owned enterprises – increases opportunities for doing business. But deeply entrenched patronage networks and electoral pressure ahead of the 2019 general elections will mean that it will be a long road to recovery for the country.

“In Zimbabwe, President Emmerson Mnangagwa announced a series of fiscal and pro-business reforms, leading to the highest improvement of the reward score in Africa. Although Zimbabwe still struggles with a severe liquidity crisis that will not be quickly solved, there has been a notable uptick in investor interest and an upgrading of growth forecasts. However, a degree of political uncertainty persists in light of an upcoming general election and conflicting interests within Mnangagwa’s cabinet.

“Mozambique records the strongest improvement in the reward score after Egypt. It has adopted a pro-investment stance and sought to reduce the state’s involvement in the economy by restructuring or privatising state-owned enterprises. These reforms have helped stabilise a fiscal situation that once looked decidedly shaky, and opened up new opportunities for foreign investors in sectors such as energy, infrastructure construction and transportation.”

Further findings of the report:

- Angola’s leadership change has not yet improved its reward score, but its risk score has gone down: Angola’s new president, João Lourenço, has acted with remarkable speed and decisiveness to consolidate his authority. Efforts to dismantle his predecessor’s networks have provided new opportunities for foreign investment in sectors previously dominated by companies linked to the former president and his family. Combined with an improved regulatory environment, investors can seek opportunities predominantly in the oil and gas, diamond, and telecommunications sectors.

Reward score: 3.65 / risk score: 6.55 - Kenya’s reward score remains one of the highest in sub-Saharan Africa, but the government’s external debt burden raises concerns: Winning the election in 2017, Kenya’s leading Jubilee Party of Kenya continues its pro-business policies. However, concerns arise over the government’s external debt burden, with a new USD 2bn Eurobond issued in February even as the proceeds of a previous issue have yet to be fully accounted for. Furthermore, improving relations between the government and the opposition will be instrumental in ensuring that political tensions do not undermine economic growth, and more prudent fiscal and macroeconomic policies are needed to maintain positive economic prospects. Reward score: 6.36 / risk score: 5.51

- Côte d’Ivoire, with a forecasted real GDP growth rate of 7% in 2018, continues its impressive economic recovery, but great challenges remain: With reforms to the business environment and efforts to bring foreign investors back after the 2010-2011 crisis, Côte d’Ivoire has achieved amongst the highest growth rates in the world in recent years, and sectors such as construction, telecommunications, banking and retail have seen considerable growth. However, severe obstacles to a full recovery persist, including political interference and corruption, socioeconomic discontent, shortcomings in security-sector reform, and growing competition ahead of the potentially volatile 2020 presidential poll.

Reward score: 6.51 / risk score: 6.24. - Senegal – growing investment and a reduced risk score presage continuous growth: Under the Emerging Senegal Plan, growth has increased steadily over the last three years, reaching close to 6.4% in 2017. Growing exports, a more diversified economy and increased interest from large international investors as a result of the promising offshore oil and gas discoveries make Senegal one of the poster children in sub-Saharan Africa. The reduction in its risk score is one of the most positive changes in the 2018 Africa Risk-Reward Index. Reward score: 5.76 / risk score: 4.56

- Morocco – economic reforms improve the country’s resilience and make its exports more competitive, but social discontent remains a challenge: With one of the lowest risk scores on the 2018 Africa Risk-Reward Index and a relatively stable reward score, Morocco’s economic reforms prove to be a success. Medium-term growth will be enhanced by continued reforms to facilitate foreign investment, access to finance, quality of education and the business environment, as these represent the primary constraints to competitiveness and doing business. However, social-economic unrest over poor living conditions persists particularly in interior regions. Reward score: 5.77 / risk score: 4.10

Distributed by APO Group on behalf of Control Risks Group Holdings Ltd.

For more information or to schedule an interview with our experts, please contact:

Friederike Lyon

Global Marketing Programme Director

Friederike.Lyon@ControlRisks.com

+49 173 619 54 66

About Control Risks

Control Risks (www.ControlRisks.com) is a specialist global risk consultancy that helps create secure, compliant and resilient organisations. We believe that taking risks is essential to success, so we provide the insight and intelligence you need to realise opportunities and grow. And we ensure you are prepared to resolve issues and crises. From the boardroom to the remotest location, we have developed an unparalleled ability to bring order to chaos and reassurance to anxiety.

About Oxford Economics

Oxford Economics (www.OxfordEconomics.com) is a world leader in global forecasting and quantitative data analysis, acting as a key adviser to corporate, financial and government decision-makers, and thought leaders. Our worldwide client base comprises international organisations, including leading multinational companies and financial institutions; key government bodies and trade associations; and top universities, consultancies and think tanks. Oxford Economics has a global team of over 200 professional economists and econometricians situated in 20 offices around the world that help clients quantify global impacts and analyse shifts in the macroeconomic environment to assess the effect on their business and organisations.

Control Risks and Oxford Economics

Control Risks and Oxford Economics have joined forces to provide an innovative political and economic risk forecasting service that takes a holistic view of risk in a complex, rapidly changing, globalised world. Control Risks and Oxford Economics combine extensive geopolitical, operational and security expertise with rigorous economic forecasts and models on 200 countries and 100 industries. Together, we offer full-spectrum consulting that enables your organisation to navigate the world of political and economic risk. Covering all aspects of the investment journey, including security and integrity risk, our joint consultancy practice can overlay geopolitical and economic scenarios to bring new insights and direction.